The past 12 months have been one of the best times for global banking in over a decade. Rising interest rates have created a headwind and boosted profits at a time when macroeconomic uncertainty still leads the headlines every day. Unfortunately, this positive momentum has done little to change the value of these companies or provide value to their shareholders.

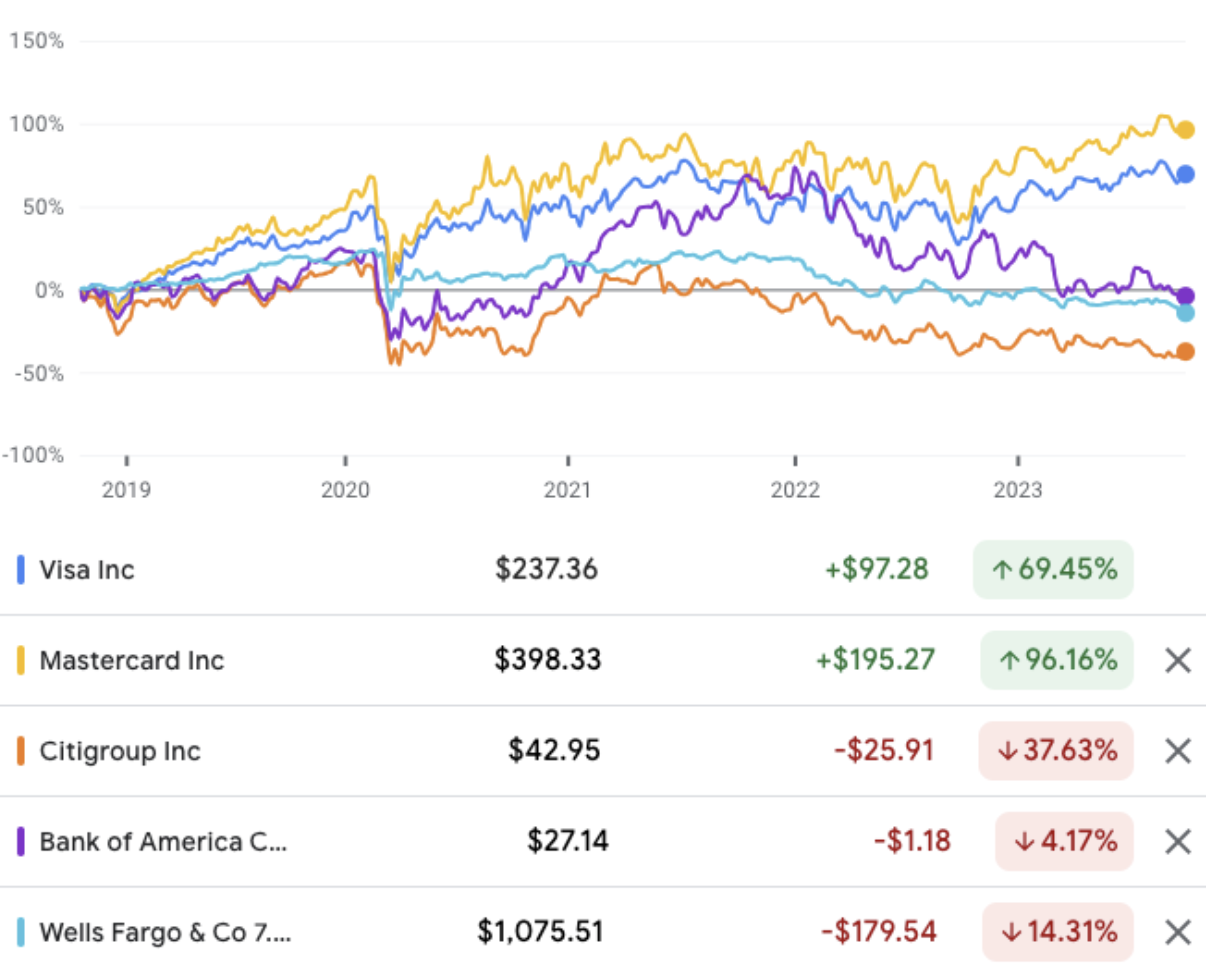

This becomes a larger problem when compared to other areas of the financial industry. The banking industry is lagging behind other types of financial institutions, currently being led by payment providers regarding profit and growth. A simple look at stock value comparing 3 of the largest US banks versus 2 of the largest players in payment shows a stark contrast in financial success over the past 5 years.

* Chart represents stock market value on Oct 13th, 2023, Google Finance

These returns at a time when the banking industry has the opportunity to thrive show that there is a greater problem that needs to be addressed. A focus on operational excellence, decision making and priority around cost, efficiency, customer retention and growth, as well as other areas of performance are more important than ever for the banking industry, as is the use of technology to differentiate the way they operate and provide value to their customers and shareholders alike.

There is no doubt that there are several priorities for the banking industry, managing the balance sheet, understanding their transactional business and adapting to the existing macroeconomic environmental risks lead the way however exploiting new technologies to provide value to their customers and shareholders needs to be on the top of the priority list.

From a consumer perspective, further development and enhancement of mobile banking, personalization and virtual assistants are key areas where technology investment has the opportunity to create the greatest returns.

Utilizing AI and machine learning to create a better customer experience offering more personalized product recommendations and quicker customer support will enhance consumer sentiment, reduce costs and increase company value.

Enhancement of mobile applications focusing on ease of use to enhance the ability to perform transactions, access account information and manage finances seamlessly.

Similar to the consumer experience, the banking industry has the opportunity to simplify and enhance its operations through AI and machine learning. Some of these areas include:

Advanced-Data Analytics to gain deeper insights into consumer behavior, allowing banks to understand better their needs and preferences as well as detecting and preventing fraud and cybersecurity threats in real-time.

Dynamic Credit Scoring allows for the extensions of loans and credit to happen faster and to a broader range of customers. In addition to this, automated credit risk modelling will help lenders make better lending decisions.

Automation and Process Optimization allows for routine back-office tasks like data entry, document processing and compliance checks to be completed more efficiently while creating more streamlined digital onboarding processes for new customer registration and product activation.

All of these priorities have significant implications for the capital plans of individual banks, however, the ROI against these types of initiatives has the potential to separate them from their competition. There have been very few industries that have not been disrupted through the adoption of technologies and the traditional banking industry needs to accelerate their usage if they want to increase their value to both consumers and their own shareholders.

To learn more about how our team can help you, click the link below.